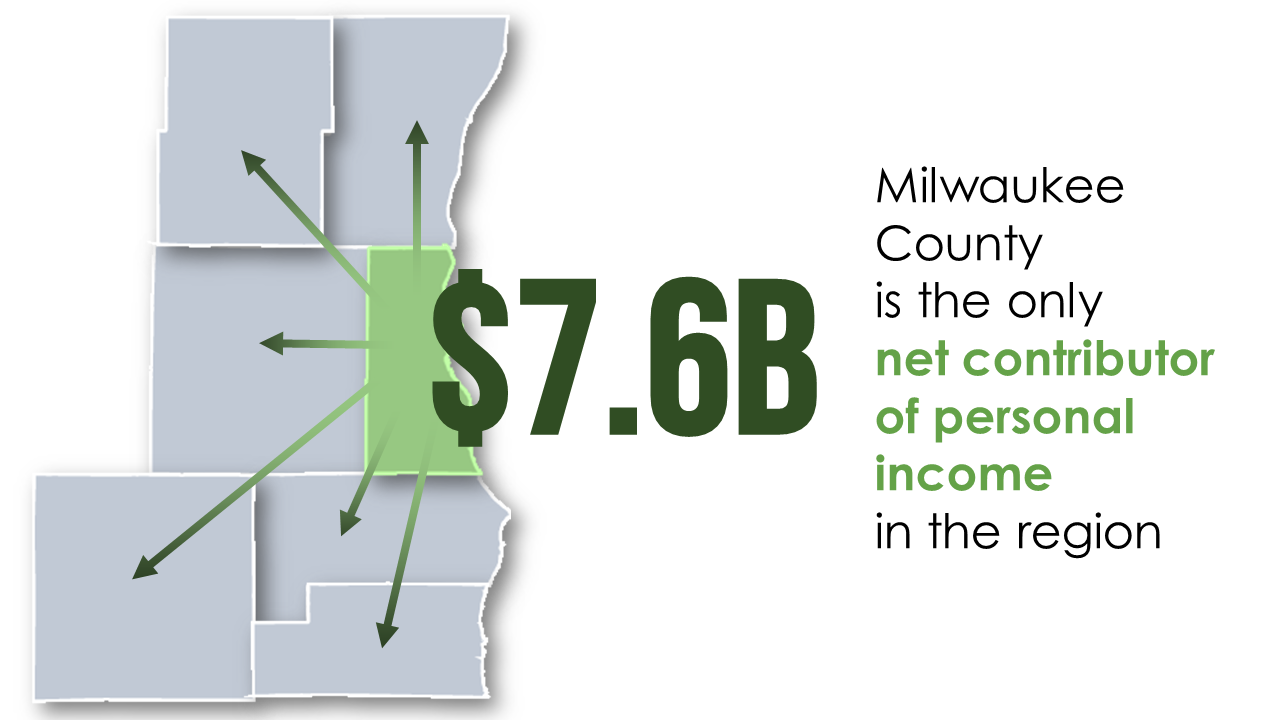

By Tim Sheehy, MMAC President Milwaukee County’s governmental leaders made an ill-informed decision some 23 years ago that substantially increased the cost of its pension plan with overly optimistic return assumptions. Despite future reforms, these pension liabilities continue to absorb over 30% of the County’s tax levy. The County has had structural deficits dating back to the early 2000’s, bolstered by stagnant state funding in the form of shared revenue, general transportation, basic community aid and mass transit operating assistance. The Counties funding structure limits revenue growth to about 1% per year. How has the County reacted? It has cut spending over the past decade by $380M. The largest chunk of savings came from a 46% reduction in staff – from 7,300 full-time equivalents to 3,900. Unfortunately, to balance its budgets has also deferred maintenance and reduced its capital spending, which leaves an $828M backlog through 2028. The sum of these actions still leaves Milwaukee County with a deficit in 2024 of $18M. Going forward its pension costs (which were $60M in 2015) will peak at over $120M by 2027. This will help drive the county’s structural deficit to $109M by 2028. While all this seems bleak, if state aid had kept pace with inflation over the past decade, the county would receive an additional $83M in 2023. The current shared revenue proposal contained in AB 245 would provide Milwaukee County with an additional $7M in aid on top of the $47M it currently receives. While this is helpful, it will not provide a path to fiscal solvency and a chance to eliminate the ongoing structural deficit. The County needs an additional sales tax of up to .5% to address its unfunded pension liabilities for current and past employees. The goal is to freeze the plan for new employees and have those employees funded in the State pension plan. Increased shared revenue and a sales tax dedicated to pension obligations will provide the county with better footing to serve its citizens, businesses and visitors. Milwaukee County is not only home to 928,000 residents, but it draws in millions of visitors to attend the cultural, arts and entertainment assets that call Milwaukee County home. Most importantly, it is the hub of the five-county regional economy. Some $7.6B in personal income is earned in Milwaukee County by residents who live in Waukesha, Washington, Ozaukee and Racine. This income is exported out of Milwaukee County for these residents to spend on homes, schooling and other goods and services in their home counties. The regional economy relies on the relationship of this talent base and the employers in Milwaukee County. No other county has this interdependence, nor an export of net personal income. Left unchecked, Milwaukee’s fiscal crisis will not be self-contained. The Milwaukee County board and its County Executive are best suited to balance all these varied interests, while being held accountable for the use of the sales tax. This is why a sales tax is needed and why we have representative government.

Comments are closed.

|

|

Copyright © 2024 Metropolitan Milwaukee Association of Commerce

All rights reserved. 301 W Wisconsin Ave., Ste. 220 | Milwaukee, WI 53203 Tel 414/287-4100 | Fax 414/271-7753 | [email protected] | Privacy Policy |

|

RSS Feed

RSS Feed